Welcome to

Shorepointe Benefits.

“Knowledge is power” – Sir Francis Bacon

Our passion is education, making sure you have the tools and information to make the best decision for your health care insurance needs. There is no ‘one size fits all’ policy and just because your brother, sister or neighbor has ‘that’ plan doesn’t mean it is the right plan for you.

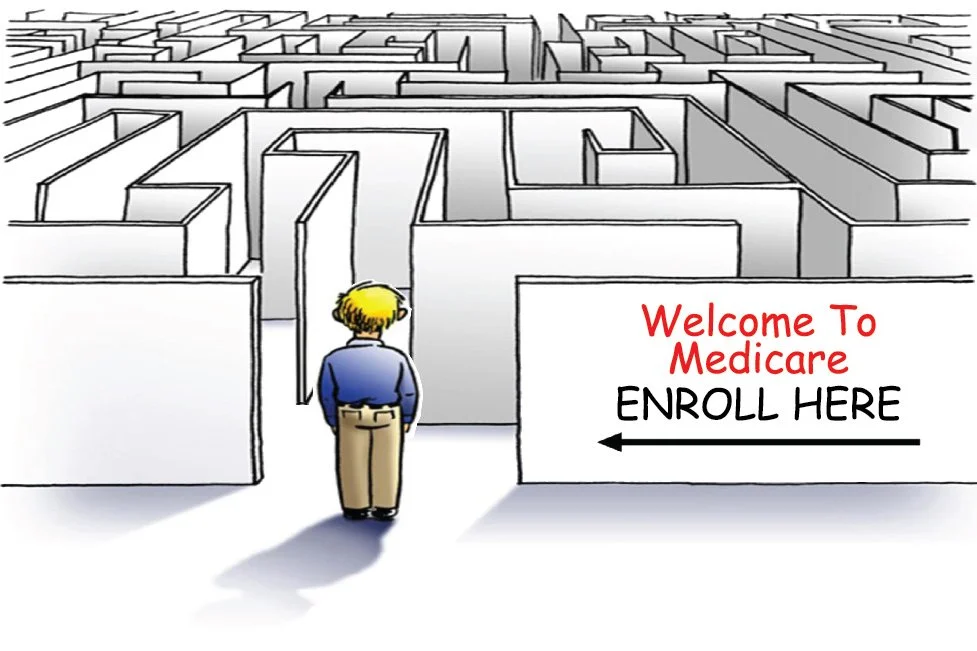

Let’s face it, Medicare is confusing! With over 25 years of experience in the insurance industry, Shorepointe Benefits has the education, experience, and expertise to help you navigate your journey into the unknown.

The decisions you make with regard to your insurance can have a tremendous impact on your finances should you choose the wrong coverage and suffer a chronic or serious illness. The expertise and valuable coverage we provide our clients help them leave their worries behind so they can focus on the things in life that make them happy.

Being a member of the National Association of Health Underwriters makes us part of an elite group of health insurance professionals — those who have dedicated their careers to the principle that everyone should have adequate and affordable health insurance coverage. NAHU advocates for members on legislative issues, provides professional development and delivers resources to promote excellence.

Medicare Supplement Accredited Advisor, and member of National Association of Medicare Supplement Advisors (NAMSA).

The services we provide.

Education: Eligibility, coverage options, money saving ideas

Enrollment: Online or paperwork completed and submitted, I take care of every detail

Customer Service: Customer focused, responsive and thorough

Monitoring: Ongoing review of your health insurance needs and plans

Advocacy: Work as a liaison between you and the insurance company

Proud Members of:

Member of National Association of Medicare Supplement and Medicare Advantage Producers

Fast Results

Customer focused, responsive and thorough!

Knowledgeable

25+ Years experience in the insurance industry!

Great Results

See our customer testimonials!

Frequently Asked Questions:

Some of our great supplemental insurance providers

Get Shorepointe Benefits Working For You Today!

Click here to go to our contact page and choose the option most convenient for you Email, Phone or Contact Form!